Shareholder Alignment - A pocket guide to LaS and DaS 2025

Everything you need to know about the Loyalty as Shares and Dividends as Shares initiatives.

Loyalty as Shares (LaS) and Dividends as Shares (DaS) were developed as part of the Shareholder Alignment project with the aim of increasing the number of growers who own Zespri shares. You can read more about this project on the Share Alignment page.

Eligible growers can receive their June loyalty payment as Zespri shares instead of cash.

Eligible shareholders can reinvest all or part of their July dividend payment into Zespri shares.

These initiatives launched in 2025 to help remove barriers to share ownership by allowing growers to buy shares without needing large upfront cash payments or broker accounts. They are a third option for eligible growers to purchase Zespri shares outside of on-market and off-market trading.

The ‘strike price’ (ex-dividend price that the Zespri shares were sold for under the LaS and DaS share issue) was based on the Independent Share Valuation by third-party valuer, Northington Partners. The Indicative Price Range of $5.55–$6.05 per share was announced in May 2025 with the final ‘strike price’ of $5.75 confirmed on 18 June 2025.

Participation in LaS and DaS exceeded expectations, with 638 entities participating in LaS (23% of all producing entities as of 9 July 2025), and 277 shareholders participating in DaS (10% of producing entities). Zespri welcomed 327 new shareholders, lifting grower ownership from 48% to 61%.

Following the strong uptake, Zespri announced a share buy-back would take place in August 2025. The buy-back provided a low-cost opportunity for shareholders wishing to rebalance or exit their investment, while also helping reduce the dilutionary impact from LaS and DaS and enabling the return of some surplus capital.

The buy-back ‘strike price’ of $5.90 per share was based on Northington Partners valuation guidance which assessed that the cumulative value of holding Zespri shares for three months from July to September 2025 was approximately $0.15 per share. This was added to the LaS and DaS strike price of $5.75 per share to determine the buy-back price of $5.90 per share. The buy-back resulted in the cancellation of 2.1m shares, and reduced the number of dry shareholders from 205 to 164, reducing the percentage of dry shares and shares above the 6:1 cap to 3.9%.

Below you can find all the resources created to help guide you through the LaS and DaS process and a place to review some commonly asked questions and results from the 2025 offers.

Zespri has now issued new shares to all growers who opted into the 2025 Loyalty as Shares (LaS) and Dividend as Shares (DaS) initiatives. This is done by giving you the option to divert money owed to you by Zespri into Zespri shares, eliminating the need to go through lengthy AML processes to open accounts with Brokers or having to find an off-market seller.

The uptake has exceeded the targets set for this year, reflecting strong grower engagement and participation, and the potential impact of well-designed initiatives that address barriers to ownership and make the process simple for growers.

To be eligible to participate in LaS you must:

Have supplied Zespri with a Schedule 5 Supply Agreement

Be due the Loyalty payment

Be a current producer

Be a resident in New Zealand

Have a valid lease agreement with a term of at least 12 months (Lease Agreement) and have provided to Zespri a copy of the Lease Agreement or a statutory declaration from the owner, lessee and solicitor as to the terms of the Lease Agreement; and

Have the available headroom to acquire more shares.

To be eligible to participate in DaS you must:

Zespri shareholders who are still current producers (owners or lessees of land in New Zealand on which kiwifruit is grown for supply to Zespri)

Be a resident in New Zealand

Have a valid lease agreement with a term of at least 12 months (Lease Agreement) and have provided to Zespri a copy of the Lease Agreement or a statutory declaration from the owner, lessee and solicitor as to the terms of the Lease Agreement; and

Have the available headroom to acquire more shares.

This is commonly known as a Dividend Reinvestment Plan which allows shareholders to have their dividend reinvested in additional shares rather that receiving the dividend as a cash payment.

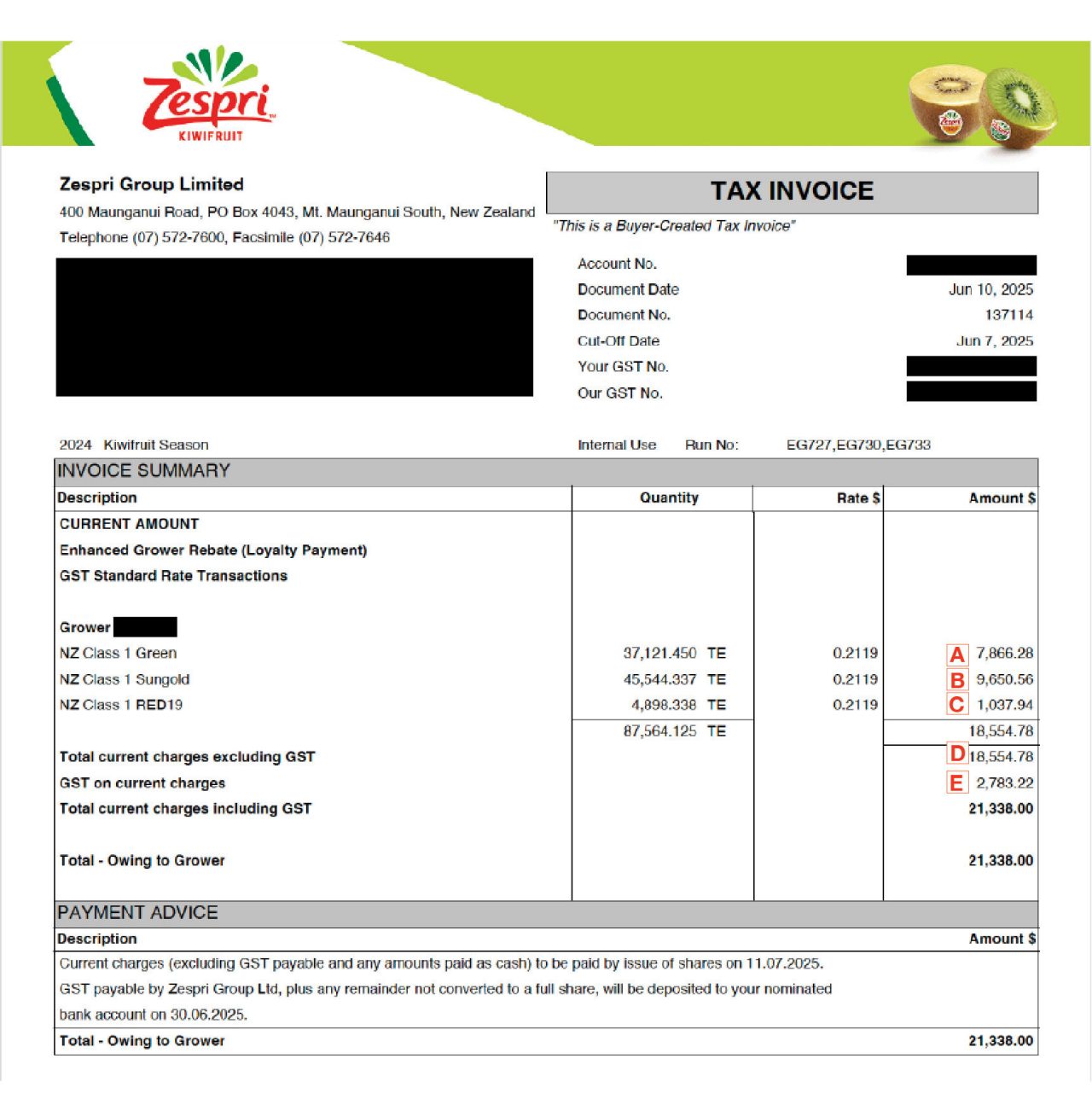

You should have received an invoice from Zespri (Zespri Generated Invoice). This document is created on your behalf so Zespri can process your Loyalty payment. This was supplied at an entity level and has a breakdown of your KPINs and payment by purchase pool type and takes into account if you have participated in LaS or not.

Even though this is an invoice, you don’t need to pay anything (we are paying you). You will need to keep these as a record to pass on to your accountant.

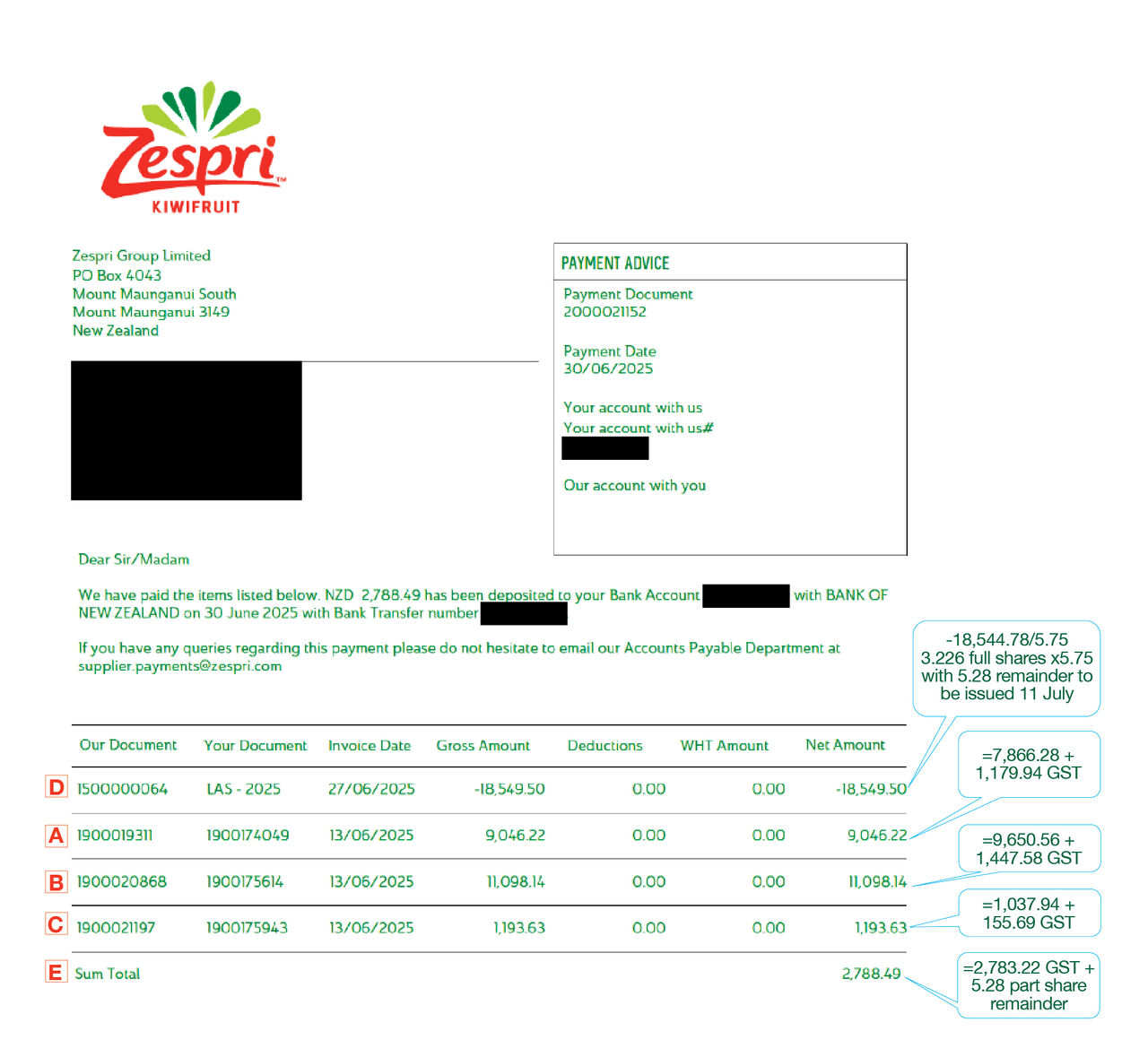

You should have also received a payment advice. This was created when the payment was made and will show what Zespri paid you, and into which account. If you opted in to LaS then the payment shows what amount of money was used to convert into Shares and the remainder paid is the GST and rounding for any part share.

Below are examples of the two documents which will help understand what was issued and what was paid as well as any information you will need to pass onto your accountant.

Alongside the two documents growers receive for their loyalty payment, growers can also go to the Industry Portal to view information for their loyalty payment in the reports section.

Selection of the ‘second loyalty payment’ filter will reflect the combination of the Zespri Generated Invoice and Loyalty Remittance Advice as above. This report provides details by pool and grower code for the loyalty payment which was made directly to your nominated account.

If you participated in LaS, you’re also able to see this converted to shares. Access to view these reports are available to an individual who is connected to the entity and who has the relevant permission and authorisation. If you are not able to view these reports ,and believe you should have access, please contact the Grower Support Services team to discuss requesting access.

Under the revised loyalty agreement, the loyalty premium will be calculated across Free on-Board Stowed (FOBS) trays, but paid across all trays submitted. This has the effect of spreading the premium and the fruit loss risk across all trays that make it into submit.

While the impact on average is very small, paying on submit trays has a greater proportional impact on growers who ship later and who have much higher fruit loss percentage than the season average. This revision does not change the total value of loyalty paid out and was agreed by the Industry Advisory Council in February 2024 for loyalty payments from January 2025.

Read more on the Loyalty Payments page.

All loyalty payments from 2025 will be made directly from Zespri to Growers’ nominated bank account, rather than being paid from your post-harvest entity.

We now require growers' bank account details, even if you do not intend on opting-in for the Loyalty as Shares initiatives for the second payment.

Key takeaways are:

Some growers have already supplied Zespri with their bank details. If you have, you will need to verify we have the right account details for your entity. If you haven’t had a direct payment from Zespri, we will need to collect your bank account and GST details to ensure we have time to pay your first loyalty rebate in January of each year. You will need to provide proof of your bank account details. Confirmation of bank accounts should include the account name and account number e.g. MJ Family trust. We will not accept the name being the “everyday account”.

Zespri will store your details securely in our system, in accordance with our privacy policy which you can view at zespri.com/en-NZ/privacypolicy.

Please refer to instructions linked below for how to update or verify your bank account details.

The share buy-back offer period closed and the final calculation date on 19 September with a settlement date of 30 September 2025 when 2.1m shares were cancelled. The buy-back partially reduced the overall dilutionary effect from the earlier LaS and DaS share issue.

It also contributed meaningfully to our progress in reducing dry grower shareholding by reducing the total number of dry shareholders from 205 to 164. For more information on our goals and targets go to the Share Alignment page here.

Why is share alignment so important?

Aligning the commercial interests of growers will help us to make more positive decisions to create value for growers, to respond faster to challenges, and will mean more growers have a say in the direction of Zespri and the industry and will help to keep the industry together, ensuring the Single Desk continues to work for all growers.

Is there a target in terms of improving grower shareholding in Zespri?

Yes, we’ve set ourselves three targets. As part of our goal to improve the number of New Zealand growers owning Zespri shares, we’ve set a target of having at least 75 percent of New Zealand growers as shareholders by 2030. We also want to improve alignment, and want at least 60 percent of New Zealand growers to hold shares at a ratio of between 0.5 and 2.0 shares per tray of production by 2030. As part of our efforts to minimise shareholder dilution, we’ve also set a target for the percentage of dry shares, and shares above the 6:1 cap, to be below five percent by 2028.

Imputation credits allow shareholders to benefit from the income tax that Zespri has already paid. This means Zespri’s profits are not taxed twice when paid to the shareholder. A shareholder can use the imputation credit to reduce the income tax they have to pay on dividends they have received from Zespri. Computershare calculate the tax payable on the dividend payment and withhold this for payment direct to the IRD. The amount of tax withheld will be shown on your dividend statement which is sent by Computershare on payment date.

Will existing shareholdings be ‘diluted’ if new shares are issued in lieu of loyalty payments or dividends?

Dilution refers to the reduction of ownership percentage of existing shareholders in a company when new shares are issued by the company. As new shares are being issued as part of the LaS and Das initiatives, the ownership percentage of existing shareholders (who do not opt-in to LaS or DaS initiatives) will be reduced. A reduction in ownership percentage may result in:

Any new shares issued will be issued at a price that the Zespri Board has determined to be fair and reasonable to Zespri and all shareholders, and will be supported by an independent valuation. At the time of issue, as the new capital funding is at a fair price and results in higher Zespri cash holdings, the value of all shares should not be impacted.

Dilution of share value would occur if the new shares were given away or exchanged for less than fair value. In those circumstance the value of the company is being “split" more ways with no incoming funds or less than fair value incoming funds. That’s not happening under these initiatives. Growers who opt-in are purchasing their new shares with their loyalty funds or dividends. The new shares are not gifted, the issue of shares is an injection of new capital into Zespri.

How are these initiatives good for existing shareholders?

The intention of LaS and DaS is to increase the number of growers who own Zespri shares. This helps to align the commercial incentives of growers so we’re better placed to make the right commercial decisions to create value for growers. More growers owning shares in Zespri, and benefitting from both fruit returns and the performance of the corporate and with more control over the future of the industry, is critical to our ability to make positive commercial decisions, to create ongoing value and to respond to challenges. It will help us to build a more resilient business and to ensure the Single Desk continues to work well for growers.

What will Zespri do with the capital injection from loyalty or dividends not paid out?

Zespri doesn’t really need capital and returns most earnings to shareholders as dividends. To assist in achieving Zespri's alignment aspirations and to reduce the dilutionary effect of LaS and DaS on shareholders, Zespri intends to return some or all funds raised under LaS and DaS to shareholders periodically. This may be via a share buy-back or other appropriate form of capital return. Funds raised under LaS and DaS which are not returned to shareholders are expected to be used to fund Zespri’s growth initiatives.

As a buy-back allows Zespri to re-balance the number of shares on issue, any decision to proceed with any further buy-backs will depend on the level of uptake for new shares through LaS and DaS or any future initiatives. Further updates on any potential buy-back will be communicated through Kiwiflier, Canopy, and other industry channels as soon as it is finalised.

If further buy-backs do proceed, the method for deriving a buy-back price will use the same valuation process that will be used for setting the strike price for LaS and DaS, unless a material change occurs to the share price or business operating environment. The maximum number of shares sought through a potential buy-back will reflect the funds raised through the LaS and DaS. In other words, the value of the buy-back will likely not exceed the combined funds raised by the LaS and DaS initiatives and may be a lesser amount if the Zespri Board choose to increase the number of shares on issue to more closely match NZ tray production. As any share issue is seeking to improve share alignment rather than seeking to raise capital, the most effective use of these funds is to facilitate the buy-back. Further updates on any potential buy-back will be communicated through Kiwiflier, Canopy, and other industry channels as soon as it is finalised.

As with any share capital, the funds could be used to:

Will you be buying back existing shares or issuing new shares?

The shares were newly issued under the Loyalty and Dividends as shares initiatives and the acquired shares brought under the buy-back process were immediately cancelled. Zespri has obtained a binding ruling from the IRD to ensure that any buy-back proceeds paid to eligible selling shareholders is tax free.

Where do the LaS and DaS shares come from?

Shares are issued by Zespri Group Limited.

Do these shares carry equal voting rights with other Zespri shares?

Yes. Shares issued under the LaS and DaS initiatives will carry equal voting rights with other Zespri ordinary shares and will have the rights (including voting rights) prescribed under Zespri’s constitution. Note that Zespri’s constitution qualifies normal voting rights. For a summary of the key features of Zespri’s shares please refer to section 5 of the Product Disclosure Statement available on Canopy here and on the Companies Office website here by searching for offer number OFR13848.

Are there any restrictions on selling these shares? Does a minimum holding time apply?

There will not be any restriction on selling the shares issued under the LaS and DaS initiatives and no minimum holding time will apply. The shares issued will be the same as any other Zespri ordinary share, as soon as you own the shares you will be free to sell at any time provided a buyer is available and the shares are not on a trading halt.

What is the advantage of opting in to these initiatives rather than simply getting cash and buying shares?

Growers have highlighted that there is a strong desire to avoid having to make a significant upfront outlay of cash in buying shares. The two options we’ve announced reflect that feedback and are designed to make beginning or increasing Zespri shareholdings easier for growers. Purchasing shares directly from Zespri will also avoid brokerage fees, and does not require additional anti-money laundering compliance checks.

Why should I participate?

Growers have told us that buying shares is onerous and complicated. Many of you have also said you are busy running your orchards and don't know a lot about buying shares nor have the time to get your heads around it. The upfront cost of buying is also a barrier. LaS and DaS are designed to make it easier to start to buy Zespri shares or to buy more. This is done by giving you the option to divert money owed to you by Zespri into Zespri shares, eliminating the need to go through lengthy Anti-Money Laundering processes to open accounts with Brokers or having to find an off-market seller.

Why should I opt-in?

We have an Investing in Zespri and a Performance of Zespri Shares page with more information on the importance of an aligned industry and the benefits of owning shares. That includes explaining the potential benefits of investing in Zespri shares, details around dividends and the importance of your vote to our governance and key decisions at our Annual Meeting which directly affect you. We are owned and controlled by our growers, and believe that being invested in the Company that represents you and your fruit is in the best interest of our industry. You should always seek independent advice and do your own research before making any investment decisions.

What is your expectation on uptake of the Loyalty as Shares and Dividend as Shares options? Could the volume of shares be significant compared to normal trading and affect share price?

With these initiatives (LaS, DaS and buy-back) Zespri is offering an alternate mechanism to purchasing and selling Zespri shares, in addition to the USX market and off-market options that currently exist. With the introduction of a new trading mechanism, the proportion of trading on the existing mechanisms will reduce. The introduction of an additional mechanism should overall increase share trading liquidity / activity as the ‘friction’ to conduct Zespri share trading is reduced.

Can overshared and dry shareholders opt-in?

No. The LaS and DaS options will be available to growers and shareholders subject to the eligibility criteria above.

If I opt-in will I remain opted in for future years?

For LaS, you will remain opted in unless you change your grower number (if this happens you will just need to opt-in under the new grower number the following year), you choose to opt-out or you don’t meet the eligibility criteria.

For DaS, you will remain opted-in for future years unless you choose to opt-out. Every year you will have the option to change the percentage participation amount for DaS should you wish and as long as you meet the eligibility criteria. You will be able to choose from either 25, 50, 75 or 100 percent, should you want to invest some or all your dividends into more shares.

I won’t have access to the Industry Portal during the LaS/DaS opt-in period. How will I be able to opt-in?

The offer period will be open for 10 working days, and you will not be able to opt-in before or after that period. You can log into Canopy and the Industry Portal on your smart phone if you have access to a stable internet connection, but you may find it easier to read on a bigger screen.

In order to be well prepared, we encourage you to check your access to the Industry Portal as soon as possible and that you can see all the organisations you believe you should be able to. Logging in early ensures you can access the system smoothly and resolve any issues ahead of time, rather than facing potential delays or difficulties when the offer period is open.

If you are not going to be able to access the Industry Portal during the offer period, then please reach out to the Zespri Investor Relations team to discuss your individual options. You can contact the team via email to shares@zespri.com or by calling 07 572 6402.

Will you offer a discount to market price to incentivise uptake? Will the valuation take this into account?

There is no plan to offer a discount to the fair and reasonable price of shares. Any discount applied is effectively a cost to existing shareholders.

What is the ‘strike price’ and what is the process for valuing the company?

The ‘strike price’ is the ex-dividend price that Zespri shares will be sold for under LaS and DaS. This price will be set by the Zespri Board after receiving an Independent Share valuation by a third party valuer Northington Partners.

Is there any guarantee that the strike price is fair? What if the market price changes after I opt in?

Zespri Directors are required to sign a resolution when setting the strike price, that it is fair and reasonable to all existing and new shareholders. If a situation arose prior to the shares being issued/repurchased that the strike price was no longer fair and reasonable, then the Board would be required to either amend the strike price, or cancel the applicable share issue/buy-back. If you wish to opt in, you would need to make the decision taking into account all risks, including short term price volatility.

Are grower directors who own Zespri shares part of the decision to set a strike price? Is this a conflict?

Yes, grower directors will be part of the decision, but actual or perceived conflicts will be managed. The full board will be involved in the decision. This includes grower directors who can own Zespri shares. Conflicts on share issues are managed by placing trading halts on directors while they could have information that other shareholders (and potential shareholders) do not have (and sometimes placing all shares into a trading halt until information is available to all). This means directors cannot trade shares while in possession of price sensitive information. The strike price will be set considering an independent valuation.

I want to own the shares in a different entity than the one that gets my loyalty payment – can I ‘assign’ the shares? What about assigning to an entity that is not a ‘grower’?

Zespri shares can only be issued or sold to a current Producer. The Loyalty Agreement is direct with either the Landowner or Lessee (the crop owners supplying to Zespri) so assignment to anyone else is not possible in these initiatives. Dry Shareholder or Overshared Growers will not be eligible to participate in these initiatives due to the constitution rules around ownership of Zespri Shares.

My orchard is leased – who gets the option for Las and DaS – the landowner or lessee?

Under Zespri’s constitution, when an orchard is leased both the landowner and lessee are able to purchase shares. The LaS option will be made available to the party that is entitled to the Loyalty payment which could either be the Landowner or Lessee. Zespri will communicate directly with the entity that has signed up to the Schedule 5 and is contracted to supply their fruit to Zespri. The DaS option will be made available to the Zespri shareholder who is entitled to a dividend. Another consideration is the landowner priority rule which means for a leased orchard, the landowner has priority to own shares, and the lessee is only entitled to any balance of shares available under the 6 shares to 1 tray cap. Please consult with the relevant party if your property is leased to understand the total production cap for that KPIN.

I am the landowner but not the crop owner (lessee). Why am I not entitled to participate in LaS when I am still a grower?

The LaS initiative is aimed at those growers who are submitting the crop to Zespri and are therefore entitled to receive the June loyalty payment. The LaS and DaS initiatives are the first wave of changes Zespri is making to improve share alignment. Industry consultation on the next phase of options to improve alignment will take place from June.

How does the landowner priority rule apply (e.g. the landowner is overshared, I’m the lessee and want loyalty/dividend as shares).

The landowner priority rule means that the landowner has priority to ownership of Zespri shares, and the lessee is only entitled to any balance of shares available under the “6 shares :1 tray” cap for the production off the orchard. There is no change to the landowner priority rule. This means that if the landowner has exceeded the 6:1 cap the lessee of the orchard will not be able to obtain shares under the LaS or DaS initiatives. In addition, the Lessee may be required to sell their shares after the sanction period if the landowner has purchased additional shares under the LaS/DaS schemes and the orchard in now over the 6:1 cap. If you opt-in and we find you don’t have eligibility to buy shares through LaS or DaS we will communicate this with you.

Is there a risk that the USX market price is less than the strike price on the share issue date?

There is always a risk of USX market share price changes over the offer term period. Typically investors treat shares as a longer term investment – meaning that short term price variations are less relevant than the long term capital growth and dividend income.

What risk do I take on by acquiring Zespri shares?

As with any share, there is always the risk that the share performs worse than expected leading to share price decreases, and/or dividends are not at the level expected. Nothing about future performance is guaranteed. Zespri Group Limited is a limited liability company. What this means is that owners of fully paid Zespri shares can lose their investment in the company, but their liability is limited to the amount of their investment. So shareholders are not ‘on the hook’ beyond the potential to lose the value of their shares.

Will the LaS be inclusive or exclusive of GST?

Exclusive. GST related to the loyalty will be paid late June with any share rounding remainder.

Why is GST being paid out on the LaS?

The final instalment of the loyalty payment received by growers is actually made up of two parts: the loyalty payment itself, and GST. Under LaS, only the loyalty payment component is used to buy Zespri shares. This allows the grower to receive the GST component in cash, which in most cases will then need to be paid to the IRD (although this depends on the grower's own circumstances).

What is the rounding remainder paid out on the LaS?

Zespri can only issue full shares. Any part share entitlement will be paid out in cash together with the GST component.

Is receiving dividends as shares better/worse than dividends as cash in terms of tax?

We are unable to offer advice about your tax situation – but generally we would expect the treatment should be the same as if you’d received the cash – in effect you are receiving the net after tax payment, and then those funds are being applied to a share purchase. Please see your tax adviser for specific answers about your tax situation.

If the shares go up or down in price after they have been issued is this taxable income/loss for me?

This can’t be answered specifically for you, as it depends on your own circumstances. Generally, for most investors price changes on shares are capital gains/losses and are not treated as income, but if you are a share ‘trader’ in IRD’s view you can be subject to tax on gains. You’ll need to understand your own tax situation.

The share buy-back is a voluntary option for all eligible shareholders, including those whose circumstances may have recently changed or who wish to rebalance their investment.

No, participation in the buy-back is entirely voluntary.

Your provisional entitlement is an initial estimate of the range of shares you may be eligible to sell back to Zespri under the buy-back offer.

No. Once you submit an application to participate in the buy-back, you should not buy or sell any Zespri shares until the buy-back process is complete. This ensures the integrity of the offer, and preserves the intended tax-free status of the repurchase.

There is a requirement for shareholders participating in the buy-back to sell at least 25 percent of their holdings. This minimum sale requirement is a safety margin that Zespri has calculated to try to satisfy the test for a tax-free payment for the shares. However, Zespri cannot advise on individual shareholder tax positions. Shareholders should seek independent tax advice to determine the impact of the buy-back to them, particularly if shares are held through multiple related persons or associated entities.

The buy-back offer will be made to shareholders resident in New Zealand including B class and dry shareholders. If you are unsure about your eligibility but wish to participate in a buy-back please call 07 572 6402 or via email to shares@zespri.com.

The Zespri Investor Relations team provides specialised support to the industry on everything shares related. If you have questions about shares or the share structure, please don't hesitate to ask. Email shares@zespri.com or call us on 07 572 6402.

Was this page helpful?